The IRS requires your flexible spending account (FSA) participants to submit documentation to prove their purchase was an eligible expense. The IRS emphasized these requirements and potential penalties for employers not meeting the requirements when releasing an Office of the Chief Counsel memorandum detailing medical expense claim substantiation for medical FSAs and dependent care FSAs.

That’s why you need an FSA administrator that adheres to IRS substantiation requirements and offers innovative solutions to simplify the substantiation process for your employees. Keep reading to learn more about why the IRS substantiation guidelines are important and what you and your participants can do to stay in compliance.

Why is substantiation required?

Because of an FSA’s tax advantages, the IRS requires employers and employees to prove that FSA funds are only being spent on eligible expenses.

FSAs are a great way for employers and employees to save. When employees participate in an FSA, employers save on FICA taxes since their participation reduces their taxable wages. And they save because the funds they contribute and their reimbursements for eligible expenses are not taxed.

How do substantiation requirements affect you and your employees?

FSAs are employer-sponsored accounts, so it’s particularly important for you to comply with IRS regulations regarding documentation. If the IRS determines your FSA is or was not in compliance with substantiation requirements, your FSA could become disqualified.

Last year’s memorandum states that any FSA not following substantiation rules does not comply with IRS Code Section 125 and any employee contributions to a noncompliant plan is subject to income, FICA, and FUTA taxes. In some circumstances, the IRS could treat all medical FSA reimbursements within a noncompliant plan, including those that were properly substantiated, as taxable wages and subject to FICA and FUTA taxes.

What does the IRS require for FSA substantiation?

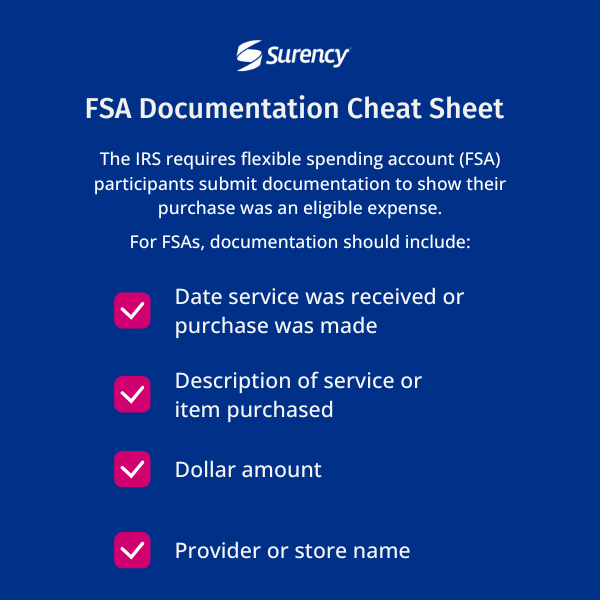

To reduce your risk as an employer and the potential for future financial headaches, choose a third-party administrator that requires claims to be substantiated. IRS regulations outline what your employees’ documentation should contain. For medical FSAs, documentation should include:

- Date service was received or purchase was made

- Description of service or item purchased

- Dollar amount

- Provider or store name

An Explanation of Benefits (EOB) typically contains the information required by the IRS.

How can Surency simplify substantiation?

Participants with an FSA powered by Surency have access to technology, processes, and educational materials to make it easier for them to access their funds. That includes:

- Our Surency benefits card automatically approves any FSA purchases on eligible expenses when used at merchants with an Inventory Information Approval System (IIAS). That’s why, on average, participants with a Surency benefits card see 85 percent of their benefits card purchases automatically approved without additional documentation.

- And in the remaining instances when more documentation is needed, our participants can easily upload it via the benefits mobile app or through their online accounts.

- Surency also provides EOB smart scan, which leverages AI technology so participants can scan an EOB right from their mobile app, which will auto-fill expense details when filing a claim.

Use this FSA documentation cheat sheet to learn more about FSA substantiation!