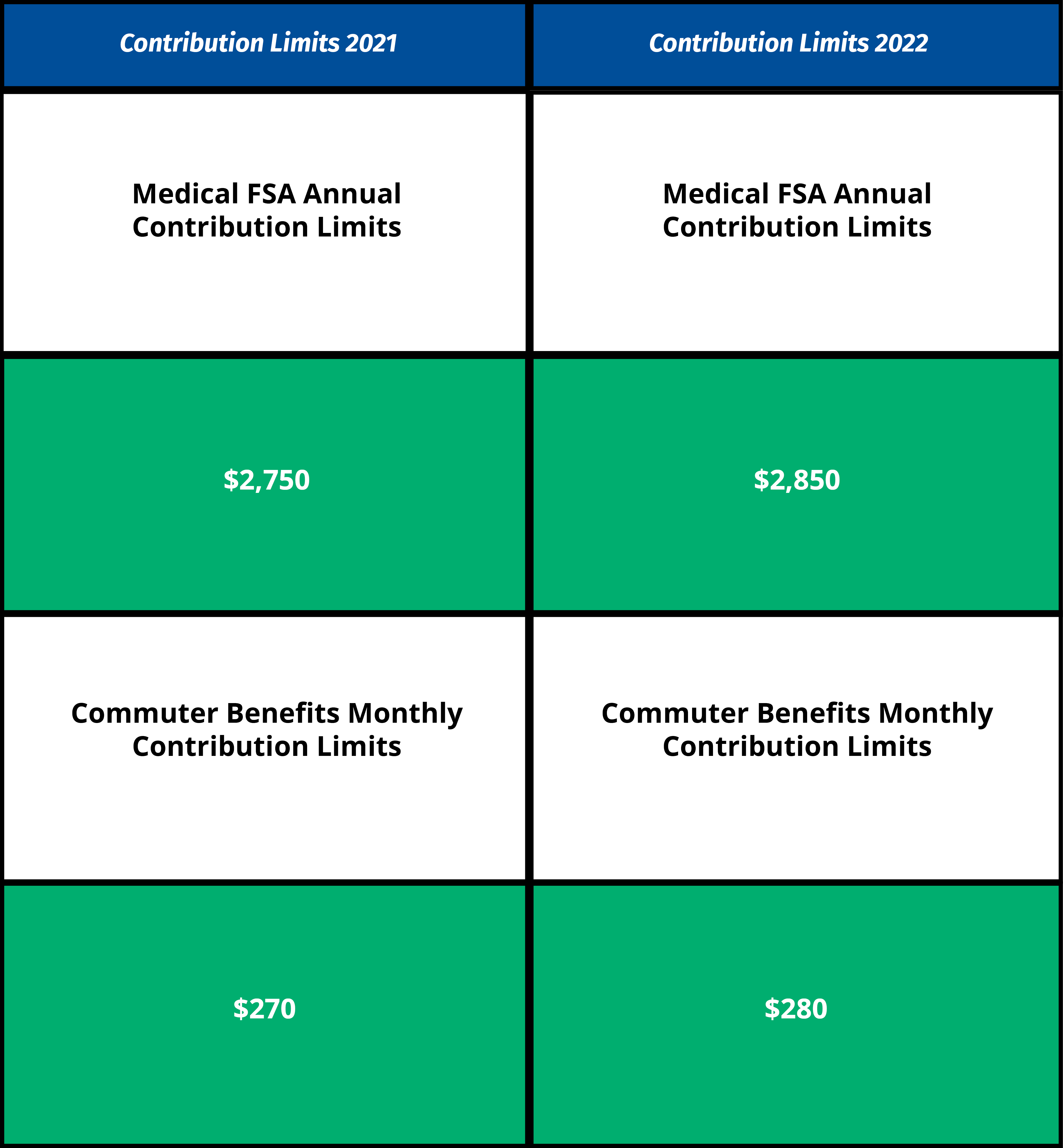

IRS UPDATE: 2022 CONTRIBUTION LIMITS

On November 10, 2021, the IRS released the 2022 Health FSA / Limited Purpose FSA and Commuter Benefits maximum contribution limits.

There are no changes to dependent care flexible spending account (DC FSA) limits for 2022. The contribution limit will remain at $5,000.

For health FSA plans that permit the carryover of unused amounts, the maximum carryover amount for 2022 is $570, an increase of $20 from the original 2021 carryover limit.

Click here for the IRS Release - Rev. Proc. 2021-45.

2022 HSA contribution limits were announced earlier this year.

Learn more about these Surency Flex products by clicking here.

If you have any questions, contact Surency at 800-264-9462, email us at flex@surency.com, or click here to submit an online Contact Us form.